owner draw quickbooks s-corp

Set up draw accounts. Ive seen that for a Corp when giving to it it should be marked as Shareholder Loan.

Solved S Corp Officer Compensation How To Enter Owner Eq

However when taking money out for repayment Ive seen it say label as Owners Draw.

. Set up and pay an owners draw. If you dont see your preferred bank account listed youll need to add it. This occurs if the S corp acquired a previous C corp that had earnings and profits or the S corp was a previous C corp and converted to S corp and also had EP.

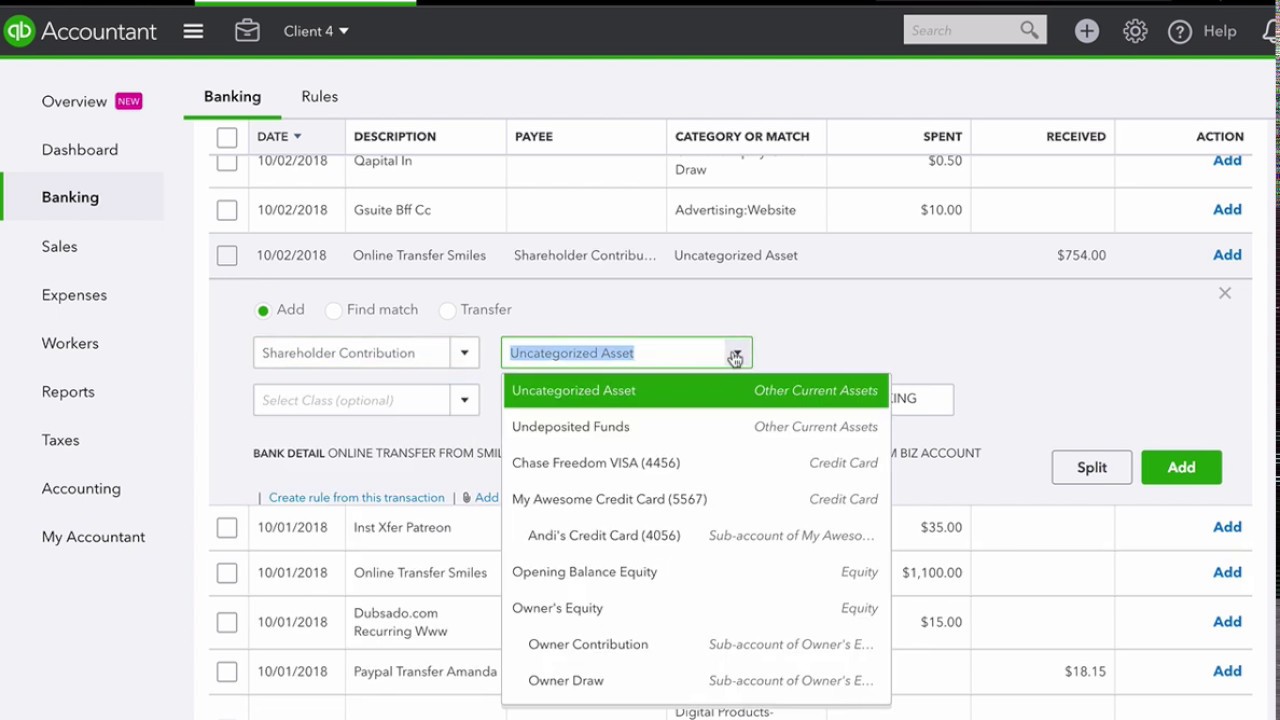

In addition there is the possibility that a distribution can be taxable if it exceeds the AAA accumulated adjustments account and there is EP earnings and profits. Owners draws can be scheduled at regular intervals or taken only when needed. Setting Up an Owners Draw Before you can record an owners draw youll first need to set one up in your Quickbooks account.

An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. The Owners draw can be setup via charts of account option. Visit the Lists option from the main menu followed by Chart of Accounts.

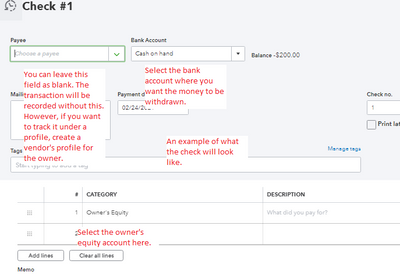

Add other details of the check such as reference number memo etc. An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys assets to pay an owner. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg.

This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop. An alternative to recording a payment in QuickBooks is to create a journal entry. The draw is a way for an owner to receive money from the company without drawing a salary.

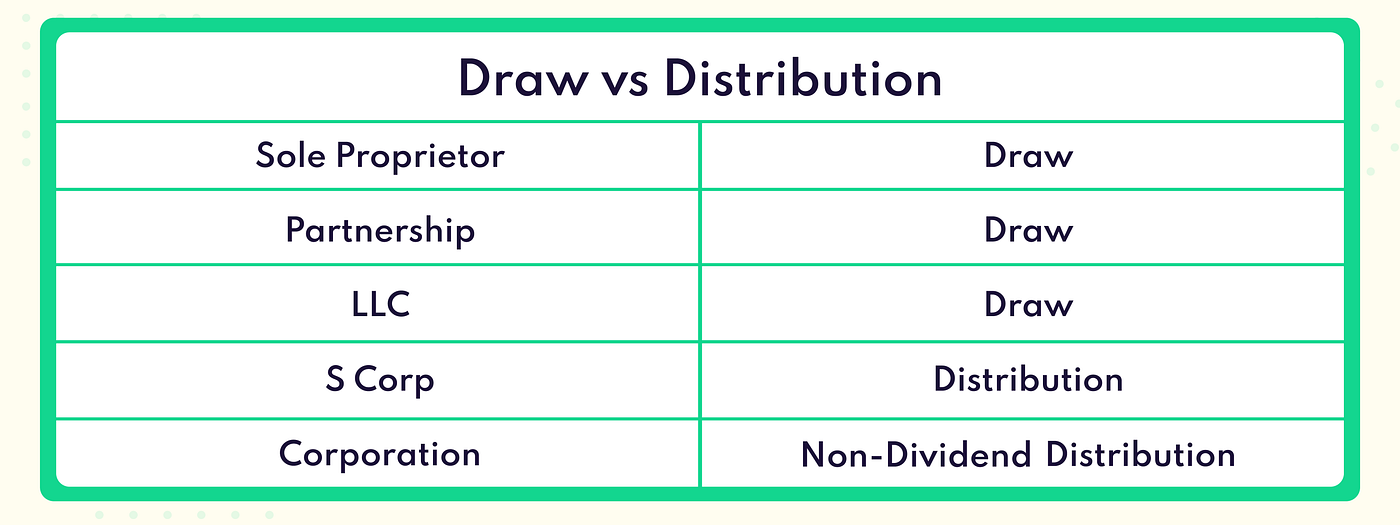

S-corp does not have equity draw and investment accounts there are shareholder accounts that can not be used the same way as the equity draw and investment are in non corporations. Ad Manage More Of Your Business All From One Place With Best-In-Class Apps. Recording draws in quickbooks requires setting up owner draw accounts and.

This article explains how to set up and process an owners draw account. But I cant find anywhere what that should be called for an S Corp. From here choose Make Deposits and then select the bank account where youd like to deposit your personal investment.

Set up and process an owners draw account. To do so you are required to select the option of Chart of account at the QuickBooks online homepage and click on the feature option and now open the new tab and move to the drop-down bar of Account Type and choose the Equity option and mention the Opening Balance in the given field. You will pay the owner using an owners draw account.

To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen. Instead you make a withdrawal from your owners equity. Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here.

An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. Since an s corp is structured as a corporation there is no owners draw only shareholder distributions. Distributions are normally tax free but if they exceed your basis shareholder value then they can be taxed as normal income.

According to IRS internal system those corporations that are elected to share the profit losses income deduction and credits to there shareholders for the purpose of paying federal taxes are called s corporations. It is not necessary that s corp is a business enterprise but elected for tax status. Once done click Save and close.

At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New. Creating humanized mobile-first experiences. One of the main differences between paying yourself a salary and taking an owners draw is the tax implications.

Because there is in Quicken no such thing as an Equity Account or Owner Draws. Under Category select the Owners Equity account then enter the amount. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

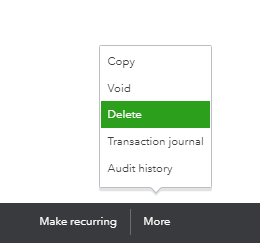

Also an accountant will be able to shed some more ideas about recording this. Youd need Quickbooks for those features. If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep.

Would it just be Shareholder Draw or should I just debit the previous Shareholder Loan account. If you have QuickBooks record this payment the same way you would a regular check as if you were paying bills. We are incredibly excited about the opportunities the public cloud provides.

But that would only apply if the S-Corp files its own return. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

If your business is formed as a C Corporation or an S Corporation you will most likely receive a paycheck just like you did when you were employed by someone else. Owners draws or withdrawals is never an expense. Create Simplify And Automate Workflows When You Integrate Your App Data.

Owners Draw Taxes. A reference for the steps can be found here. QuickBooks records the draw in an equity account that also shows the amount of the owners investment and the balance of the owners equity.

From an accounting standpoint owners draws are shown in the equity portion of the balance sheet as a reduction to the owners capital account. Members of an LLC. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks.

Make the check payable to you. We also show how to record both contributions of capita. And not part of your personal file.

S-corp does not have equity draw and investment accounts there are shareholder accounts that can not be used the same way as the equity draw and investment are in non corporations. Being a business owner there is no need to confuse between corp and s corporations. Smith Draws Post checks to.

Select Equity and Continue. But it shouldnt be used for every type of business organization. You MIGHT be able to get this to work if you set up the S-Corp in its own Q data file.

The account to charge will be Distribution or owners draw which is an equity account. Using emerging human-computer interfaces were humanizing our technology so people interact more naturally and make better decisions about managing their money.

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

How Can I Pay Owner Distributions Electronically

Solved S Corp Officer Compensation How To Enter Owner Eq

Solved S Corp Officer Compensation How To Enter Owner Eq

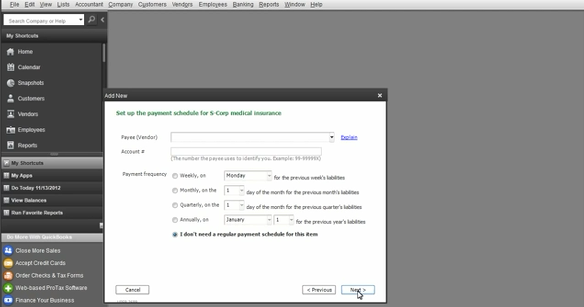

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

What Is A C Corporation What You Need To Know About C Corps Gusto

Gross Income Net Income Small Business Finance Accounting Bookkeeping Business Small Business Bookkeeping Small Business Finance

Quickbooks Owner Draws Contributions Youtube

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Quickbooks Chart Of Accounts For Contractors Small Corporation S Corp Desktop Bundle Fast Easy Accounting Store

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

How To File A Small Business Tax Return Process And Deadlines Small Business Tax Business Tax Small Business Bookkeeping

Benefits Of Owning An S Corp Taking Distributions

What Is The Difference Between An Owners Draw Vs Distribution By Let S Ledger Medium

Decide Which Business Type Is Right For You Llc Or C Corporation

How To File Self Employment Taxes For Your S Corp

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com